Micro Savings

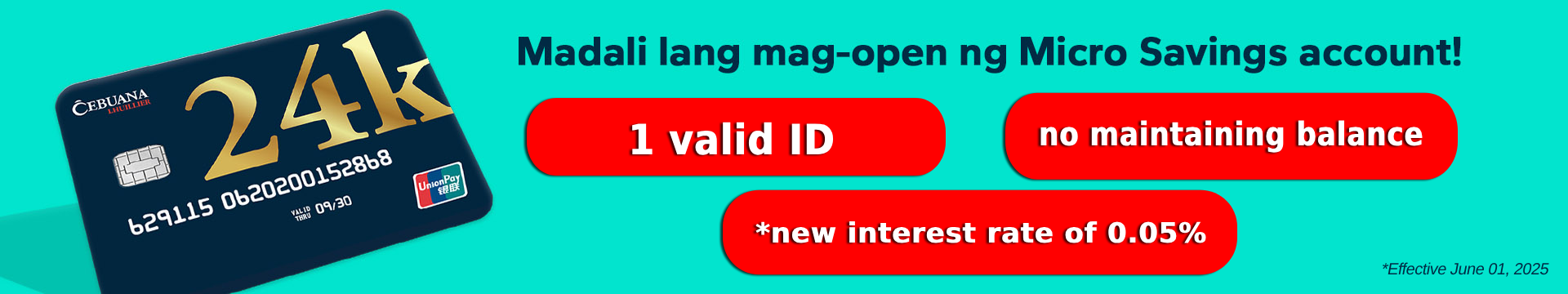

Gumawa ng small steps sa ipon goals mo with Cebuana Lhuillier Rural Bank’s Micro Savings.

I-unlock mo na ang potential ng ipon mo with Cebuana Lhuillier Rural Bank’s Micro Savings.

Now powered with a Debit Card, you are ready for any situation or transaction. Withdraw your cash at any of the 21,000 BancNet ATM’s, cashless payment in over 360,000 BancNet and UnionPay partner stores, or pay your bills online with the

eCebuana App!

One (1) Valid Id

One (1) Valid Id

PhP50.00 Initial Deposit

PhP50.00 Initial Deposit

No Maintaining Balance

No Maintaining Balance

Product Details

| Interest Rate Per Annum | 0.05% |

| Minimum Maintaining Balance | None |

| Minimum Balance to Earn Interest | Php 500 |

| Dormancy Period | None |

| Maximum Account Balance | Php 50,000 |

| Deposit Amount | Min. Php 50; Max Php 50,000 |

| Withdrawal Amount | via Cash Agent Min. Php 100; Max. Php 5,000 per transactionvia other Bank ATMs Min. Php 100; Max. Php 10,000 per transaction |

| Deposit Fee | FREE |

| Number of Allowed Withdrawals Per Day | 3 |

| Withdrawal Fee | via Cash Agent May be subject to ratesvia other Bank ATMs Varies depending on the Acquirer |

| 24K Union Pay Debit Card Fee (Replacement) | Php 150 |

Requirements

- Customer Information Sheet

- One (1) Valid Government ID (See list of valid IDs)

- P50.00 Initial Deposit

Steps on Opening a Micro Savings Account

- Pumunta sa alinman sa 3,500 Cebuana Lhuillier Branches or Cebuana Bank branch na malapit sa inyo (for more information please view our Branch Locator).

- Mag fill-out ng Customer Information Sheet (CIS) at Payment Request Form (RPF) at magpakita ang 1 Valid I.D. card.

- Makakatanggap ka ng 2 SMS na naglalaman ng account number, initial deposit at advisory message.

- I-activate ang iyong Card sa POS Terminal na matatagpuan sa alinman sa 3,500 Cebuana Lhuillier Branches o Cebuana Lhuillier Rural Bank Branches. Hintayin ang 24 – 48 hours bago gamitin ang iyong 24K Debit Card at Micro Savings Account.

Maari ring magbukas ng Micro Savings gamit ang eCebuana app. Download na!

Micro Savings Account and Cebuana Savings Account Terms and Conditions

Micro Savings Account FAQs

-

-

1. What is Micro Savings Account?

- It is an interest-bearing savings account owned by Cebuana Lhuillier Rural Bank (CLRB). It is a basic deposit type of account that allows client to save up to Php 50,000.00. The account is linked via 24K Quick Card or 24K UnionPay Debit Card.

-

2. What are the requirements?

- Requirements are as follows:

- Active 24K Quick Card or 24K UnionPay Debit Card

- Accomplished Client Information Sheet (CIS)

- 1 valid ID

- Face Image of the client (Captured within branch premise)

- Accomplished Remittance Payment Form

- Initial Deposit – Php 50.00

- Additional requirement:

-

- Purchase of the 24K UnionPay Debit Card – Php 150.00

- Or Upgrade of 24K Quick Card to 24K UnionPay Debit Card – Php 75.00*

-

- Requirements are as follows:

-

3. What are the acceptable valid IDs?

- Passport

- Driver’s License

- Professional Regulation Commission(PRC)ID

- National Bureau of Investigation (NBI)Clearance

- Police Clearance

- Postal ID

- Voter’s ID

- Government Service Insurance System (GSIS) e-Card

- Social Security System (SSS) ID

- Senior Citizen’s ID

- Overseas Workers Welfare Administration (OWWA) ID

- OFW ID

- Seaman’s Book

- Alien Certification of Registration (ACR)

- Barangay Certificate or ID (with picture and signature)

- Birth Certificate (applicable to minors only)

- Firearm License

- Immigrant Certificate of Registration

- Marriage License

- National Council for the Welfare of Disabled Persons

- New TIN ID

- PhilSys ID/ National ID

- PhilHealth ID

- Student ID

- Alien Certification of Registration (ACR) / Immigrant Certificate of Registration

- Government Office or Government Owned and Controlled Corporations (GOCC) ID (e.g. AFPID,HDMF (Pag-ibig Fund)ID, etc.

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development(DSWD)Certification

- Integrated Bar of the Philippines ID (IBP)

- Company ID issued by private entities or institutions registered with or supervised or regulated either by the BSP (Bangko Sentral ng Pilipinas),SEC(Securities and Exchange Commission) or IC (Insurance Commission)

-

4. What is the minimum amount to open an account?

- Php50.00

-

5. What is the allowed minimum and maximum amount of withdrawal?

For DEPOSIT:-

- Minimum Amount: PhP50.00

-

- Maximum Amount: No maximum limit.

-

-

-

- Bank Branch

- Accredited Cash Agents via POS Terminals

-

- Other Bank ATMs (BancNet and UnionPay Accredited Terminals Domestic and International)

-

6. What is the maximum number of withdrawals per day?

-

- Bank Branch

- Accredited Cash Agents via POS Terminals

-

- Other Bank ATMs (BancNet and UnionPay Accredited Terminals Domestic and International)

-

-

7. How much are the transaction fees?

-

- Bank Branch

- Accredited Cash Agents via POS Terminals

-

- Other Bank ATMs (BancNet and UnionPay Accredited Terminals Domestic and International)

-

-

8. What is the minimum requirement to earn interest?

- Average Daily Balance (ADB) Php 500.00

-

9. What is the interest rate per annum of Micro Savings?

- 0.05% per annum

-

10. What is the required maintaining balance?

- None.

-

11. Is there a maximum limit on the outstanding balance?

- Yes, maximum limit is Php 50,000.00

-

12. How long before an account is dormant?

- No dormancy.

-

13. How long should I wait for my card to be activated?

- Card activation takes 24 to 48 hrs.

-

14. Can I deposit/withdraw if the Micro Savings Account was opened on another branch?

- Yes.

-

15. Since 24K Quick Card and 24K UnionPay Debit Card is required to open the account, will it earn points for every deposit?

- No, points will be earned from Account Opening transaction only.

-

16. Can I process deposit/withdrawal even without 24K Quick Card or 24K UnionPay Debit Card?

- No.

-

17. Can multiple accounts be opened?

- No.

-

18. Can a non-account holder deposit/ withdraw on behalf of the account holder?

- Yes, as long as you have an authorization letter from the account holder, the 24K Quick Card or 24K UnionPay Debit Card and PIN code.

-

19. Can 24K Quick Card or 24K UnionPay Debit Card be accepted in other Bank ATMs?

- No. 24K Quick Card can only be used through the PIN Pad deployed in Cebuana Lhuillier Pawnshop Branches.

- Yes. 24K UnionPay Debit Card can be used in BancNet accredited POS and ATMs.

-

20. What is SMS Syntax?

- SMS Syntax is a self-service facility for account holders to send requests related to Micro Savings Account or 24K Quick Card and 24K UnionPay Debit Card.

-

21. What are the conditions of the SMS Syntax Services?

- Each SMS request has a maximum limit of three (3) requests per month.

- To avail the SMS Self-service Facility, client should use his/her registered mobile number in the system.

- In case the mobile number is not updated, client may file a bank request for Account Maintenance in the branch for updating of mobile number in the system. Please DO NOT process update of mobile number as PIN Reset.

-

22. What are the requests available in the SMS Syntax Service?

- Type of request:

- PIN Reset: RESETPIN

- Account Unblocking: UNBLOCK

- Card Blocking: LOSTCARD

- Balance Inquiry: BAL

- Transaction History Inquiry: HIS

- Account Number Inquiry: ACTNO

- Type of request:

-

23. How do I send request in the SMS Syntax Service?

You may send the different type of requests on the following mobile numbers below.-

- GLOBE: 0917 808 8793

- SMART: 0908 880 2930

- SUN: 0932 842 8562

-

-

24. Who can I contact for other concerns and inquiries?

You may contact our Client Care at the following details below: Phone: (02) 7759-9800 / (02) 8779-9800 SMS: 0917-8122737 (Globe) / 0918-8122737 (Smart) Operation Hours: 9:00 a.m. – 6:00 p.m., Monday – Sunday Email: [email protected]